Business Principles We Learn From Warren Buffett

Business Principles We Learn From Warren Buffett

According to Fortune Magazine the third most admired company in the world is Berkshire Hathaway. When we think of Berkshire Hathaway we think of its head – one of the wealthiest man in the world – Warren Buffett. What business principles we learn from Warren Buffett? What is his magic?

Warren is one of the best investors in the world. His approach is simple. He does not buy stocks as much as he buys businesses. He focuses on a company’s value, its stock price and its risks. He looks for companies with strong brands, simple business models, a good return on equity with a lot of debt. If the price of a firm is less than its value, Warren is interested. In doing his homework, he studies the firm’s competition, ignores what analysts have to say, and pays little attention to fluctuating market trends. In fact when the market is down, he believes that may the best time to buy.

Jim Collins' Lens

Let’s start by looking at Warren from a perspective of what Jim Collins teaches in his seminal book “Good to Great.” The book was the result of Jim’s research, where he led a team in a five-year study in which they “scoured a list of 1,435 established companies to find every extraordinary case that made a leap from average results to great results.”

Let’s start by looking at Warren from a perspective of what Jim Collins teaches in his seminal book “Good to Great.” The book was the result of Jim’s research, where he led a team in a five-year study in which they “scoured a list of 1,435 established companies to find every extraordinary case that made a leap from average results to great results.”

Jim describes the best leaders of the companies that became great as “level 5” leaders. They are ones who built “enduring greatness through a paradoxical blend of personal humility and professional will.” A level 5 leader is first and foremost ambitious for the cause.

Humble Style

Warren’s humble style is refreshing. He has simple tastes. He doesn’t wear expensive suites. He lives in the same home he bought in 1958. And, he drives his own car. Warren also is famous for how he makes fun of himself. One of his one-liners is, “I buy expensive suits. They just look cheap on me.”

Professional Will

Warren is driven as demonstrated by his almost incomprehensible wealth. Warren looks not only for businesses that are a good deal, but he looks for leaderships who have long tenures of success in their business and who are deeply passionate for the business.

Back to Jim Collins – the Hedgehog Concept

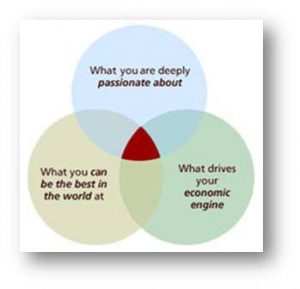

Jim’s team came to simple but powerful conclusions. One important point they make is referred to as the “hedgehog” concept. A key to greatness is finding the intersection, referred to as the sweet spot, between your talent, passion, and economic opportunity. Jim’s diagram below helps to illustrate these points.

When we look at Warren from the “hedgehog” framework, we find simple insights:

When we look at Warren from the “hedgehog” framework, we find simple insights:

Passion: What are you deeply passionate about?

Talent: What you can be the best in the world?

- “I was wired at birth to allocate capital and lucky enough to have people around me early on-my parents and teachers and Susie [his late wife]-who helped me make the most of it,” Buffett told Carol Loomis of Fortune magazine in the June 25 issue. Economics: What drives your economic engine?

- Finding great companies and leaders and investing for the long-haul

Economics: Where is there economic opportunity?

- Warren found his passion and talent in life and focused. He became one of the most successful and richest investor in history.

Business Principles We Learn from Warren Buffett